Whatsapp

WhatsappGroup

@taxreply

TaxReply

TaxReplyCommunity

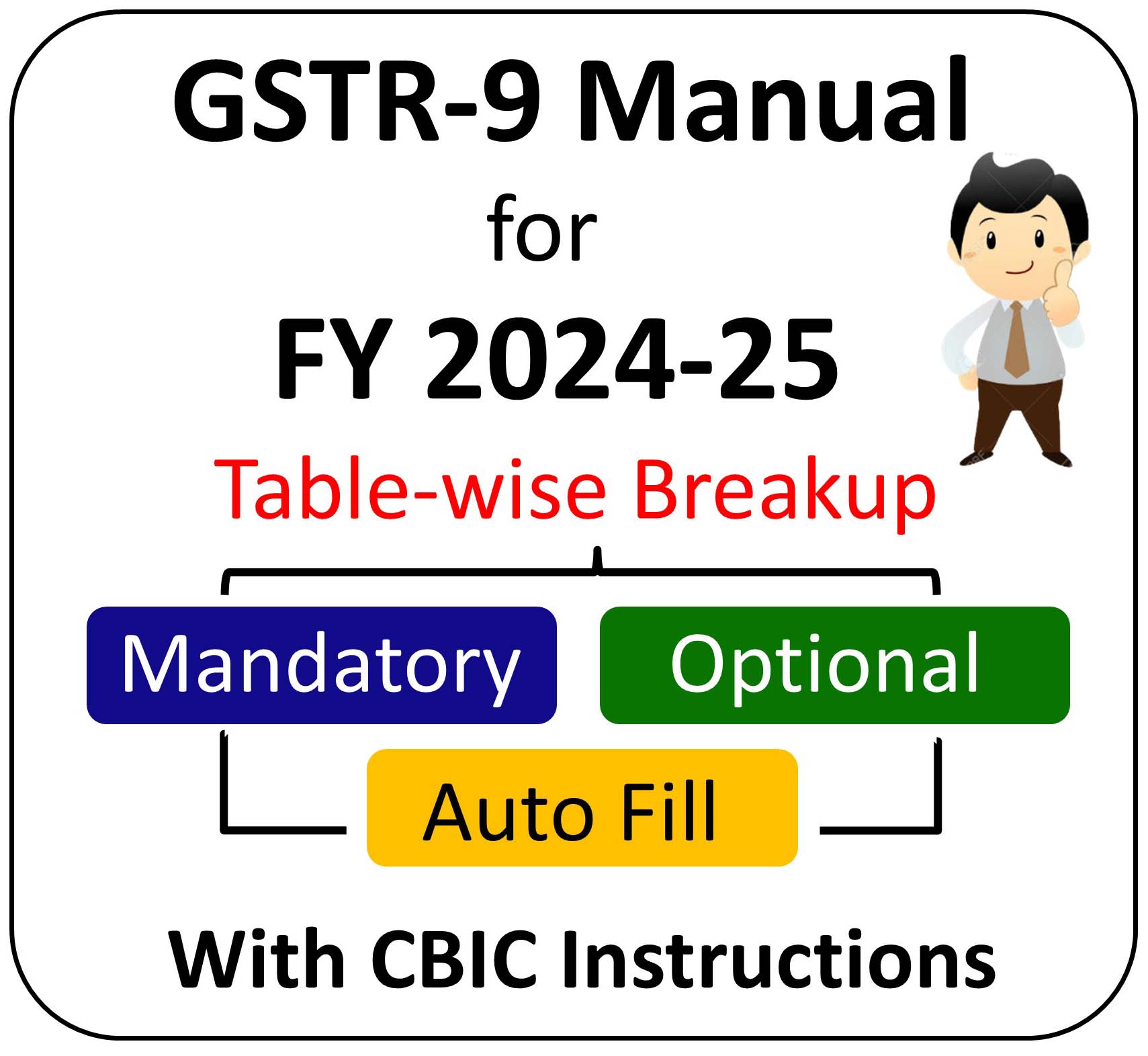

GSTR-9 Manual

(For FY 2024-25)

Updated Instructions (Table-wise)

Table 4: Details of advances, inward and outward supplies made during the financial year on which tax is payable

(4A) Supplies made to unregistered persons (B2C)

(4B) Supplies made to registered person (B2B)

(4C) Zero rated supply (Export) on payment of tax (Except supplies to SEZ)

(4D) Supplies to SEZ on payment of tax

(4F) Advances on which tax has been paid but invoice has not been issued (not covered under (A) to (E) above)

(4G) Inward supplies on which tax is to be paid on the reverse charge basis

(4G1) Supplies on which e-commerce operator is required to pay tax as per section 9(5) (including amendments, if any) [E-commerce operator to report]

(4I) Credit notes issued in respect of transactions specified in (B) to (E) above (-)

(4J) Debit notes issued in respect of transactions specified in (B) to (E) above (+)

(4K) Supplies/tax declared through Amendments (+)

(4L) Supplies/tax reduced through Amendments (-)

(4N) Supplies and advances on which tax is to be paid (H + M) above

Table 5: Details of Outward supplies made during the financial year on which tax is not payable

(5A) Zero rated supply (Export) without payment of tax

(5B) Supply to SEZ without payment of tax

(5C) Supplies on which tax is to be paid by the recipient on reverse charge basis

(5C1) Supplies on which tax is to be paid by ecommerce operators as per section 9(5) [Supplier to report]

(5E) Nil Rated

5E may be clubbed & reported in 5D.

(5F) Non-GST supply (includes no supply)

(5H) Credit notes issued in respect of transactions specified in (A to F) above (-)

5H may be clubbed & reported net of figures in 5A to 5F.

(5I) Debit Notes issued in respect of transactions specified in (A to F) above (+)

5I may be clubbed & reported net of figures in 5A to 5F.

(5J) Supplies declared through Amendments (+)

5J may be clubbed & reported net of figures in 5A to 5F.

(5K) Supplies reduced through Amendments (-)

5K may be clubbed & reported net of figures in 5A to 5F.

(5M) Turnover on which tax is not to be paid (G + L above)

(5N) Total Turnover (including advances) (4N + 5M - 4G – 4GI above)

Table 6: Details of ITC availed during the financial year

(6A) Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B)

(6A1) ITC of preceding financial year availed in the financial year (which is included in 6A above) other than ITC reclaimed under rule 37 and rule 37A

(6A2) Net ITC of the financial year = (A-A1)

(6B) Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs)

ITC on Capital goods to be shown separately. ITC on Input and Input Services may be clubbed and reported in Input Column.

(6C) Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed

ITC on Capital goods to be shown separately. ITC on Input and Input Services may be clubbed and reported in Input Column.

(6D) Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed

ITC on Capital goods to be shown separately. ITC on Input and Input Services may be clubbed and reported in Input Column.

(6E) Import of goods (including supplies from SEZ)

(6F) Import of services (excluding inward supplies from SEZ)

(6G) Input Tax credit received from ISD

(6H) Amount of ITC reclaimed under the provisions of the Act

(6K) Transition Credit through TRAN-I (including revisions if any)

(6L) Transition Credit through TRAN-II

(6M) ITC availed through ITC-01, ITC 02 and ITC-02A (other than GSTR-3B and TRAN Forms)

(6O) Total ITC availed (I + N above)

Table 7: Details of ITC Reversed and Ineligible ITC for the financial year

(7F) Reversal of TRAN-I credit

(7G) Reversal of TRAN-II credit

(7H) OTHER REVERSALS (PL. SPECIFY)

(7I) Total ITC Reversed (Sum of A to H above)

(7J) Net ITC Available for Utilization (6O - 7I)

Table 8: Other ITC related information

(8A) ITC as per GSTR-2B [Table 3 thereof]

(8C) ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during the financial year but availed in the next financial year upto specified period

(8E) ITC available but not availed

(8F) ITC available but ineligible

(8G) IGST paid on import of goods (including supplies from SEZ)

(8H) IGST credit availed on import of goods (as per 6(E) above) in the financial year

(8H1) IGST Credit availed on Import of goods in next financial year

(8J) ITC available but not availed on import of goods (Equal to I)

(8K) Total ITC to be lapsed in current financial year (E + F + J)

Table 9: Details of tax paid as declared in returns filed during the financial year

(9) Details of tax paid as declared in returns filed during the financial year

Table 10: Particulars of the transactions for the financial year declared in returns of the next financial year till the specified period

(10) Supplies / tax declared through Invoices / Debit Note / Amendments (+)

Table 11: Particulars of the transactions for the financial year declared in returns of the next financial year till the specified period

(11) Supplies / tax reduced through Amendments / Credit Note (-)

Table 12: Particulars of the transactions for the financial year declared in returns of the next financial year till the specified period

(12) ITC of the financial year reversed in the next financial year

Table 13: Particulars of the transactions for the financial year declared in returns of the next financial year till the specified period

(13) ITC of the financial year availed in the next financial year

Table 14: Differential tax paid on account of declaration in table no. 10 & 11

(14) Differential tax paid on account of declaration in 10 & 11 above

Mandatory, if Applicable.

Table 15: Particulars of Demands and Refunds

(15A) Total Refund claimed

Taxpayer has an option not to fill this table.

(15B) Total Refund sanctioned

Taxpayer has an option not to fill this table.

(15C) Total Refund Rejected

Taxpayer has an option not to fill this table.

(15D) Total Refund Pending

Taxpayer has an option not to fill this table.

(15E) Total demand of taxes

Taxpayer has an option not to fill this table.

(15F) Total taxes paid in respect of E above

Taxpayer has an option not to fill this table.

(15G) Total demands pending out of E above

Taxpayer has an option not to fill this table.

Table 16: Supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis

(16A) Supplies received from Composition taxpayers

Taxpayer has an option not to fill this table.

(16B) Deemed supply under section 143

Taxpayer has an option not to fill this table.

(16C) Goods sent on approval basis but not returned

Taxpayer has an option not to fill this table.

Table 17: HSN wise summary of Outward Supplies

(17) HSN wise summary of Outward Supplies

Table 18: HSN wise summary of Inward Supplies

(18) HSN wise summary of Inward Supplies

Taxpayer has an option not to fill this table.

Table 19: Late fee payable and paid

(19) Late fee payable and paid

Mandatory, if Applicable.

__________________

1. Inserted vide Notification No. 39/2018 – Central Tax dated 04-09-2018

2. Substituted vide Notification No. 74/2018 – Central Tax dated 31-12-2018 before it was read as

3. Substituted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019 before it was read as "to September, 2018"

4. Substituted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019 before it was read as "previous FY declared in returns of April to September of current FY or upto date of filing of annual return of previous FY whichever is earlier"

5. Omitted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019 before it was read as

"3. It may be noted that additional liability for the FY 2017-18 not declared in FORM GSTR-1 and FORM GSTR-3B may be declared in this return. However, taxpayers cannot claim input tax credit unclaimed during FY 2017-18 through this return."

6. Inserted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019

7. Inserted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019

8. Substituted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019 before it was read as “to September 2018”

9. Substituted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019 before it was read as “April to September of current FY or date of filing of Annual Return for previous financial year (for example in the annual return for the FY 2017-18, the transactions declared in April to September 2018 for the FY 2017-18 shall be declared), whichever is earlier”

10. Substituted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019 before it was read as “to September of the current financial year or date of filing of Annual Return for the previous financial year, whichever is earlier”

11. Substituted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019 before it was read as “to September of the current financial year or date of filing of Annual Return for previous financial year, whichever is earlier

12. Substituted vide Notification No. 31/2019 – Central Tax dated 28-06-2019 w.e.f. 28-06-2019 before it was read as “to September of the current financial year or date of filing of Annual Return for the previous financial year whichever is earlier”

13. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

14. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

15. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

16. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

17. Substituted vide Notification No. 56/2019 – Central Tax dated 14-11-2019 before it was read as

"2. It is mandatory to file all your FORM GSTR-1 and FORM GSTR-3B for the FY 2017-18 before filing this return. The details for the period between July 2017 to March 2018 are to be provided in this return."

18. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

19. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

20. Omitted vide Notification No. 56/2019 – Central Tax dated 14-11-2019 before it was read as "unclaimed during FY 2017-18"

21. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

22. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

23. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

24. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

25. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

26. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

27. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

28. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

29. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

30. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

31. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

32. Substituted vide Notification No. 56/2019 – Central Tax dated 14-11-2019 before it was read as "FY 2017-18"

33. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

34. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

35. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

36. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

37. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

38. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

39. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

40. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

41. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

42. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

43. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

44. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

45. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

46. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

47. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

48. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

49. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

50. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

51. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

52. Inserted vide Notification No. 56/2019 – Central Tax dated 14-11-2019

53. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as

"13[For FY 2017-18] ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 but availed during April 3[2018 to March 2019] 14[For FY 2018-19, ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2018-19 but availed during April 2019 to September 2019]"

54. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as

"15[For FY 2017-18] Particulars of the transactions for the 4[FY 2017-18 declared in returns between April 2018 till March 2019] 16[For FY 2018-19, Particulars of the transactions for the FY 2018-19 declared in returns between April 2019 till September 2019]"

55. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

56. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

57. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as "FY 2017-18 and 2018-19"

58. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

59. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

60. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as "FY 2017-18 and 2018-19"

61. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

62. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as "FY 2017-18 and 2018-19"

63. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

64. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as

"36[For FY 2017-18,] Aggregate value of input tax credit availed on all inward supplies (except those on which tax is payable on reverse charge basis but includes supply of services received from SEZs) received during July 2017 to March 2018 but credit on which was availed between April 8[2018 to March 2019] shall be declared here. 37[For FY 2018-19, Aggregate value of input tax credit availed on all inward supplies (except those on which tax is payable on reverse charge basis but includes supply of services received from SEZs) received during April 2018 to March 2019 but credit on which was availed between April 2019 to September 2019 shall be declared here.] Table 4(A)(5) of FORM GSTR-3B may be used for filling up these details. 38[For FY 2017-18 and 2018-19, the registered person shall have an option to upload the details for the entries in Table 8A to Table 8D duly signed, in PDF format in FORM GSTR-9C (without the CA certification).]"

65. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

66. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

67. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

68. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as "FY 2017-18 and 2018-19"

69. Inserted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020

70. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as "FY 2017-18 and 2018-19"

71. Substituted vide NOTIFICATION NO. 79/2020 – Central Tax dated 15-10-2020 before it was read as "FY 2017-18 and 2018-19"

72. Inserted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021

73. Substituted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021 before it was read as "and 2019-20"

74. Inserted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021

75. Inserted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021

76. Substituted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021 before it was read as "and 2019-20"

77. Substituted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021 before it was read as "FY 2019-20"

78. Substituted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021 before it was read as "2018-19 and 2019-20"

79. Inserted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021

80. Inserted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021

81. Inserted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021

82. Substituted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021 before it was read as "2018-19 and 2019-20"

83. Inserted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021

84. Substituted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021 before it was read as "2018-19 and 2019-20"

85. Substituted vide NOTIFICATION No. 30/2021–Central Tax dated 30-07-2021 before it was read as "2018-19 and 2019-20"

86. Inserted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022

87. Inserted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022

88. Substituted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022 before it was read as, "73[, 2019-20 and 2020-21]"

89. Substituted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022 before it was read as, "For FY 2019-20 74[and 2020-21]" & "77[FY 2019-20 and 2020-21]"

90. Substituted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022 before it was read as, "2019-20 and 2020-21"

91. Inserted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022

92. Inserted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022

93. Inserted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022

94. Substituted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022 before it was read as, "2019-20 and 2020-21"

95. Inserted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022

96. Substituted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022 before it was read as, "2019-20 and 2020-21"

97. Substituted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022 before it was read as, "2019-20 and 2020-21"

98. Substituted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022 before it was read as, "2019-20 and 2020-21"

99. Inserted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022

100. Inserted vide NOTIFICATION NO. 14/2022–Central Tax dated 05-07-2022

101. Substituted vide NOTIFICATION NO. 22/2022–Central Tax dated 15-11-2022 before it was read as, "between April, 2022 to September, 2022"

102. Substituted vide NOTIFICATION NO. 22/2022–Central Tax dated 15-11-2022 before it was read as, "April, 2022 to September, 2022"

103. Inserted vide NOTIFICATION NO.38/2023 – Central Tax dated 04.08.2023.

104. Substituted vide NOTIFICATION NO.38/2023–Central Tax dated 04.08.2023 before it was read as, "2020-21 and 2021-22".

105. Substituted vide NOTIFICATION NO.38/2023–Central Tax dated 04.08.2023 before it was read as, 89[FY 2019-20, 2020-21 and 2021-22].

106. Substituted vide NOTIFICATION NO.38/2023–Central Tax dated 04.08.2023 before it was read as, "2020-21 and 2021-22".

107. Inserted vide NOTIFICATION NO.38/2023 – Central Tax dated 04.08.2023.

108. Substituted vide NOTIFICATION NO.38/2023–Central Tax dated 04.08.2023 before it was read as, "2020-21 and 2021-22".

109. Inserted vide NOTIFICATION NO.38/2023 – Central Tax dated 04.08.2023.

110. Substituted vide NOTIFICATION NO.38/2023–Central Tax dated 04.08.2023 before it was read as, "2020-21 and 2021-22".

111. Substituted vide NOTIFICATION NO.38/2023–Central Tax dated 04.08.2023 before it was read as, "For FY 2021-22".

112. Inserted vide NOTIFICATION NO.12/2024 – Central Tax dated 10.07.2024.

113. Substituted vide NOTIFICATION NO.12/2024 – Central Tax dated 10.07.2024 before it was read as, ”Sub-total (A to G above)”

114. Substituted vide NOTIFICATION NO.12/2024 – Central Tax dated 10.07.2024 before it was read as, “Total Turnover (including advances) (4N + 5M - 4G above)”

115. Substituted vide NOTIFICATION NO.12/2024–Central Tax dated 10.07.2024 before it was read as, "2021-22 and 2022-23".

116. Substituted vide NOTIFICATION NO.12/2024–Central Tax dated 10.07.2024 before it was read as, "105[FY 2019-20, 2020-21, 2021-22 and 2022-23]".

117. Substituted vide NOTIFICATION NO.12/2024–Central Tax dated 10.07.2024 before it was read as, "2021-22 and 2022-23".

118. Substituted vide NOTIFICATION NO.20/2024- Central Tax dated 08.10.2024 before it was read as,

|

A |

ITC as per GSTR-2A (Table 3 & 5 thereof) |

|

|

|

|

119. Inserted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025.

120. Omitted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as “(other than B above)”

121. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

|

J |

Difference (I - A above) |

|

|

|

|

122. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

|

M |

Any other ITC availed but not specified above |

|

|

|

|

123. Inserted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025.

124. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

|

B |

ITC as per sum total of 6(B) and 6(H) above |

|

|

|

|

125. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

|

I |

Difference (G-H) |

|

|

|

|

126. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

|

9 |

Description |

Tax Payable |

Paid through cash |

Paid through ITC |

|

||

|

Central Tax |

State Tax / UT Tax |

Integrated Tax |

Cess |

||||

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

|

Integrated Tax |

|

|

|

|

|

|

|

Central Tax |

|

|

|

|

|

|

|

|

State/UT Tax |

|

|

|

|

|

|

|

|

Cess |

|

|

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

|

Late fee |

|

|

|

|

|

|

|

Penalty |

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

127. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

|

10 |

Supplies / tax declared through Amendments (+) (net of debit notes) |

|

|

|

|

|

|

11 |

Supplies / tax reduced through Amendments (-) (net of credit notes) |

|

|

|

|

|

|

12 |

Reversal of ITC availed during previous financial year |

|

|

|

|

|

|

13 |

ITC availed for the previous financial year |

|

|

|

|

|

|

14 |

Differential tax paid on account of declaration in 10 & 11 above |

|||||

|

|

Description |

Payable |

Paid |

|||

|

1 |

2 |

3 |

||||

|

|

Integrated Tax |

|

|

|||

|

Central Tax |

|

|

||||

|

State/UT Tax |

|

|

||||

|

Cess |

|

|

||||

|

Interest |

|

|

||||

128. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

“1. Terms used:

a. GSTIN: Goods and Services Tax Identification Number

b. UQC: Unit Quantity Code

c. HSN: Harmonized System of Nomenclature Code”

129. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

“2022-23 and 2023-24”

130. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

“taxpayer”

131. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

|

6M |

Details of ITC availed but not covered in any of heads specified under 6B to 6L above shall be declared here. Details of ITC availed through FORM ITC-01 and FORM ITC-02 in the financial year shall be declared here. |

132. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

|

7A, 7B, 7C, 7D, 7E, 7F, 7G and 7H |

Details of input tax credit reversed due to ineligibility or reversals required under rule 37, 39, 42 and 43 of the CGST Rules, 2017 shall be declared here. This column should also contain details of any input tax credit reversed under section 17(5) of the CGST Act, 2017 and details of ineligible transition credit claimed under FORM GST TRAN-I or FORM GST TRAN-II and then subsequently reversed. Table 4(B) of FORM GSTR-3B may be used for filling up these details. Any ITC reversed through FORM ITC -03 shall be declared in 7H. If the amount stated in Table 4D of FORM GSTR-3B was not included in table 4A of FORM GSTR-3B, then no entry should be made in table 7E of FORM GSTR-9. However, if amount mentioned in table 4D of FORM GSTR-3B was included in table 4A of FORM GSTR-3B, then entry will come in 7E of FORM GSTR-9. 31[For 62[FY 2017-18, 78[2018-19, 90[2019-20, 106[2020-21, 117[2021-22, 2022-23 and 2023-24]]]]], the registered person shall have an option to either fill his information on reversals separately in Table 7A to 7E or report the entire amount of reversal under Table 7H only. However, reversals on account of TRAN-1 credit (Table 7F) and TRAN-2 (Table 7G) are to be mandatorily reported.] |

133. Substituted vide NOTIFICATION NO.13/2025- Central Tax dated 17.09.2025 w.e.f. 22.09.2025. Before it was as,

“only”

Digital GST Library

Plan starts from

₹ 5,000/-

(For 1 Year)